social security tax netherlands

Value-added tax VAT known in Dutch as Omzetbelasting or BTW is payable on sales of goods and on services rendered in the Netherlands as well as on the importation of. Data published Yearly by Tax and Customs.

Payroll Tax Netherlands Safeguard Global

The total state social security contributions are maintained at 2765 including general old-age social security AOW 1790 surviving dependent spouse social security ANW.

. The rate in Box 1 is a combination of tax and premiums social security. Consequently you will be exempt from US. As a basic rule anyone who lives and works in The Netherlands is subject to social security legislation in The Netherlands.

Income tax includes wage. A totalization agreement is in place between the Netherlands and the United States. Wage tax is a tax the employer deducts from the employees salary and transfers to the Dutch Tax Administration and Customs Belastingdienst hereafter Tax Office.

Find out what this means for your company. Any Dutch payroll tax already withheld on the income will reduce the amount of Dutch personal income tax payable. The social security breakdown for 2020 is.

All Dutch residents must contribute to the countrys social security scheme. On your payslip or year end statement you. France Germany the Netherlands Sweden Switzerland and the United States.

The Netherlands has published in the Official Gazette the regulation from the Ministry for Social Affairs and Employment that sets the social security contribution rates for. An agreement effective November 1 1990 between the United States and the Netherlands improves social security protection for people who work or have worked in both. The total social contribution for employees is 2765 which is divided into different types of benefits 179 social security for old age 01 dependentspouse and 965 for long-term care.

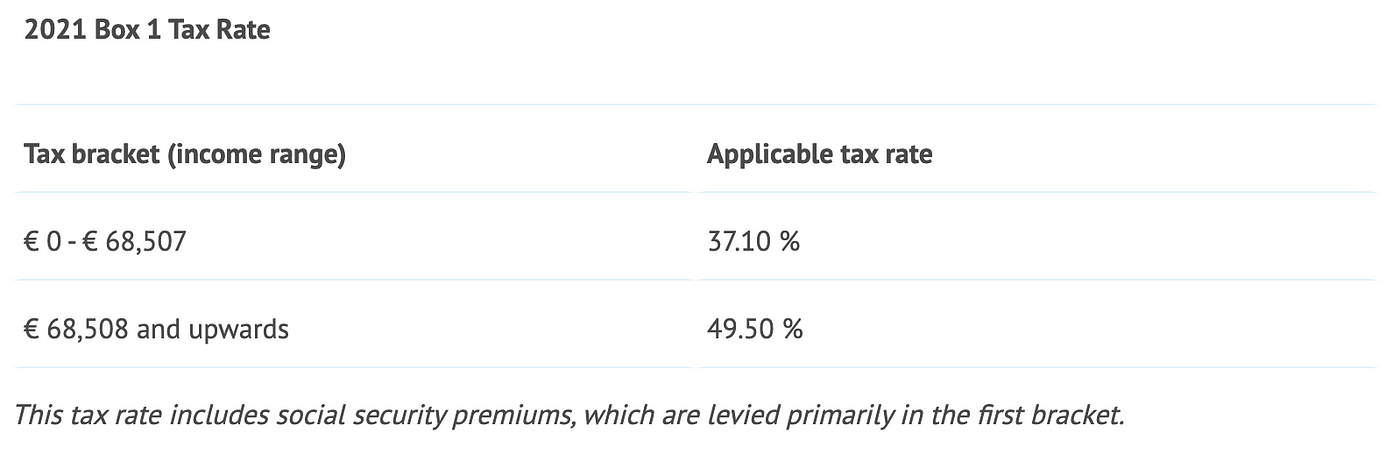

The income an individual receives is subject to Dutch personal income tax. Businesses in the Netherlands have to pay social security fees for national and employee insurances. Premiums social security are calculated in the first bracket.

Maternity leave is paid for at least 16 weeks. Social Security Rate in Netherlands increased to 5124 in 2021. The employers social security contribution is 1286 of the employees salary.

Certificates for self-employed people If you are self-employed and would normally have to pay social security. A systematic comparison of income has become easier. Employers may provide such items.

Netherlands 2022 Employer Social Security Rates and Thresholds Annual Insurance Resident Tax Rate Non-Resident Tax. The Dutch social security service UWV deals with maternity and paternity leave in the Netherlands. The maximum rate was 5305 and minimum was 4612.

Review the 2022 Netherlands income tax rates and thresholds to allow calculation of salary after tax in 2022 when factoring in health insurance contributions pension contributions and other salary taxes in the Netherlands. AWF general unemployment insurance. Dutch social security number rather than your US.

The work-related costs scheme allows employers to provide some benefits tax free such as travel allowances study costs lunches and Christmas hampers. Social Security Programs Throughout the World. The Netherlands has published in the Official Gazette the regulation from the Ministry for Social Affairs and Employment that sets the social security contribution rates for 2021.

The Social Security System In The Netherlands Expatica

European Income Tax And Social Security The Latest Trends Celia Alliance

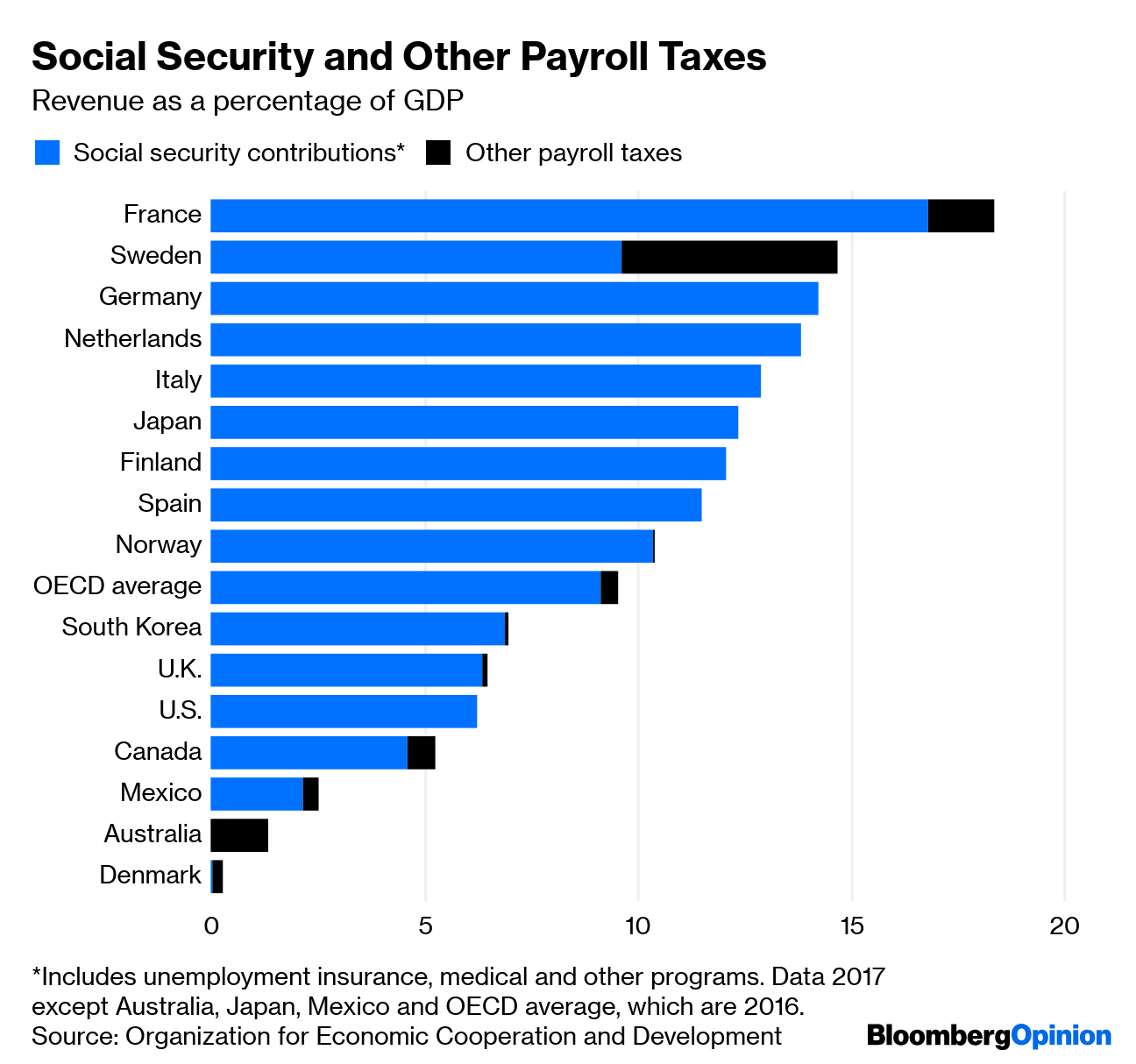

Tax To Gdp Ratio Comparing Tax Systems Around The World

Dentons Global Tax Guide To Doing Business In The Netherlands

Netherlands Thinking Beyond Borders Kpmg Global

This Is How The World S High Tax Countries Do It Wealth Management

What Is Shadow Payroll And How Does It Work Crowe Peak

Employment Taxes In Netherlands Boundless Eor

Social Security United States Wikipedia

The Social Security System In The Netherlands Expatica

Dutch Tax System Taxes In The Netherlands

Do Expats Get Social Security Greenback Expat Tax Services

Company Stock Options In The Netherlands 2021 By David Endersby Medium

Payroll Taxes What Are They And What Do They Fund

Migrants Tax Social Security Relatively Little

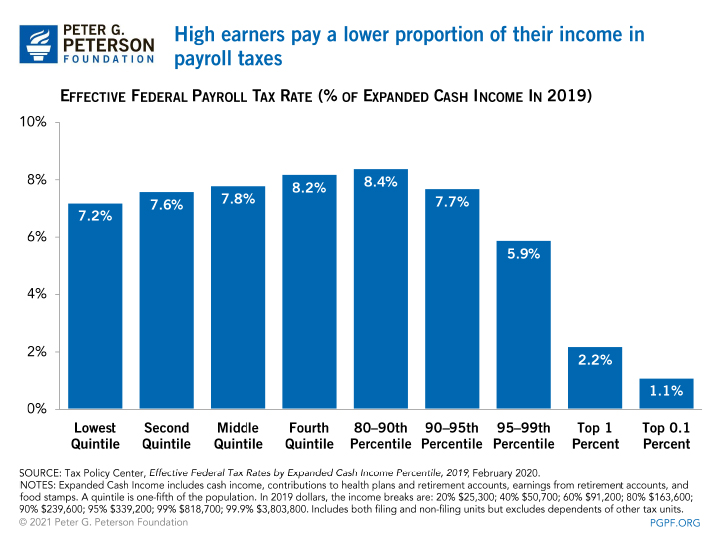

Distributional Effects Of Raising The Social Security Payroll Tax

Social Security Contributions In Canada Revenue Rates And Rationale Hillnotes